Barrier Coatings for Packaging Market Size, Trends, Segments, Share and Companies 2025-35

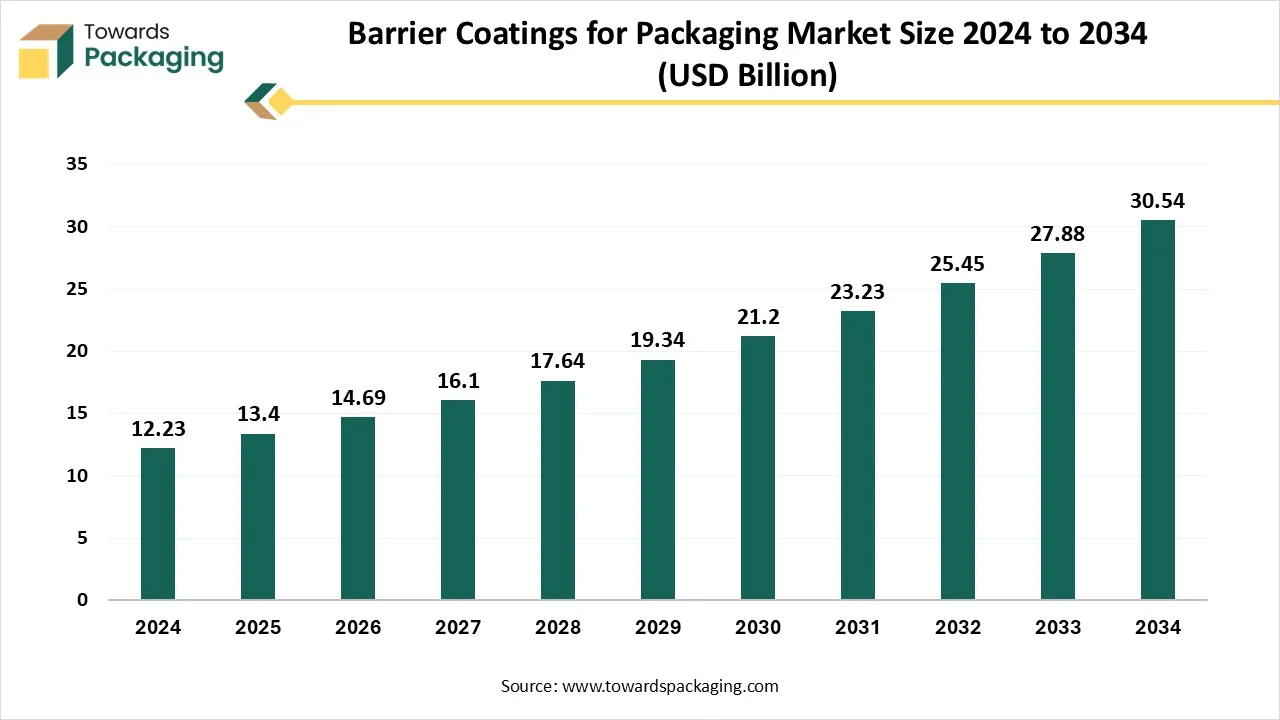

As highlighted by Towards Packaging research, the global barrier coatings for packaging market, valued at USD 13.4 billion in 2025, is expected to reach USD 30.54 billion by 2034, registering a CAGR of 9.6% throughout the forecast period.

Ottawa, Nov. 10, 2025 (GLOBE NEWSWIRE) -- The global barrier coatings for packaging market hit USD 13.4 billion in 2025, with current forecasts pointing to USD 30.54 billion by 2034, according to Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

The market is important because these coatings protect products, along with extend shelf life, and improve packaging functionality while allowing a shift towards more sustainable, eco-friendly options to traditional plastics. They are vital for industries such as food, beverage, and even pharmaceutical, where they prevent moisture, grease, and oxygen from degrading products and also causing contamination.

What is Meant by Barrier Coatings for Packaging?

Barrier coatings are considered protective layers applied to packaging to prevent substances such as moisture, oil, oxygen, and chemicals from passing through. Barrier coatings are significant for packaging as they protect products from external elements such as moisture, oxygen, and grease, which helps maintain product freshness along extends shelf life. They also prevent internal contents from leaking and can offer additional benefits such as heat-sealability and printability, while also aiding in meeting food safety and even sustainability regulations.

Key Private Industry Investments and Strategic Innovations for the Barrier Coatings of Packaging Market:

- Sustainable Water-Based and Bio-based Coatings: Companies are investing heavily in developing water-based and bio-based coatings derived from renewable materials like plant sources to create recyclable and compostable packaging.

- Nano-Enabled Barrier Technology: Investment is directed toward hybrid and nano-enabled barrier coatings that enhance protection against oxygen and moisture, extending shelf life, and offering advanced performance for high-end applications.

- Monomaterial Structure Innovations: The industry is focusing on developing single-polymer barrier packaging solutions (monomaterials) that simplify recycling by eliminating the need to separate different material layers.

- Replacement of PFAS and PVDC: Significant effort is underway to develop and commercialize safer, PFAS-free barrier coatings to meet evolving regulations and environmental standards.

-

Strategic Collaborations: Major chemical and packaging companies are pursuing strategic partnerships, acquisitions, and joint ventures to accelerate the development and market entry of new, sustainable barrier coating technologies.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5545

What are the Latest Trends in the Barrier Coatings for Packaging Market?

Development of Enhanced Functional Properties

This is due to the need for better product protection, increased sustainability, and extended shelf life. This includes enhancing resistance to oxygen, moisture, and grease, as well as adding new capabilities such as antimicrobial properties, to encounter stricter food safety regulations and consumer requirements for higher quality products. Meanwhile, stricter regulations in the food and even pharmaceutical industries drive the demand for coatings with improved barrier properties to guarantee product safety and stability.

Shift toward sustainable and eco-friendly solutions

Driven by stringent environmental regulations and rising consumer awareness, there is a significant move towards developing water-based, bio-based, and compostable barrier coatings that can replace traditional plastic films and enhance the recyclability or repulpability of paper-based packaging.

Growing demand for high-performance, functional coatings

The market is increasingly focused on innovative coating technologies, such as nanotechnology and active barriers, that provide enhanced protection against moisture, oxygen, oil, and grease to extend product shelf life without compromising on the packaging's sustainability goals.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

What Potentiates the Growth of the Barrier Coatings for Packaging Market?

Increasing Demand for Sustainable Packaging Solutions

This is driven by rising consumer pressure for eco-friendly packaging, stricter government regulations, as well as the need to extend product shelf life, driving producers to develop recyclable and even high-performance barrier solutions. Growing consumer knowledge and government regulations, like taxes on single-use plastics, are pushing brands to accept more sustainable packaging. Meanwhile, barrier coatings are considered the key to meeting these demands without compromising product quality. The market is shifting towards coatings that are recyclable or compostable themselves, which is important for a truly circular economy. Companies are developing water-driven, bio-based, and a few sustainable barrier coatings designed to improve the recyclability of the entire package.

Limitations & Challenges

Key limitations and challenges in the market include sustainability concerns, technical hurdles, and cost issues. The availability and expense of bio-based raw materials are subject to seasonal along agricultural variations, creating supply chain inconsistencies. Thus, some plastic-free coatings struggle to manage their integrity under extreme temperatures, sterilization, or humidity, limiting their usage in applications such as frozen or medical packaging.

Regional Analysis

Who is the Leader in the Barrier Coatings for Packaging Market?

North America leads the market because of a combination of strong consumer need for recyclable packaging, along with strict regulatory policies favoring sustainable options, advanced manufacturing infrastructure, together with a large market for food, beverage, and even pharmaceutical products. Meanwhile, stringent food safety standards, like those set by the FDA, and labels such as the USDA Certified Biobased Product Label, and create a favorable environment for the acceptance of safer, certified coatings across numerous packaging applications.

U.S. Barrier Coatings for Packaging Market Trends

Key trends in the U.S. market for barrier coatings for packaging involve a strong shift toward sustainable and even recyclable solutions, like water-based and bio-based coatings, driven by consumer need and regulations. A major trend is the move away from conventional plastics toward sustainable options. This includes increased usage of biodegradable and even compostable coatings such as PLA and dispersion coatings, mainly in flexible paper packaging.

Canada Market Trends

The Canadian market is driven by a strong requirement for sustainable, high-performance, and even recyclable alternatives in the food along pharmaceutical sectors, influenced by strict government regulations and rising consumer environmental awareness. Thus, the thriving food and pharmaceutical industries are major users of high-barrier films and coatings, necessitating developed protection for their products.

How is the Opportunistic Rise of Europe in Barrier Coatings for Packaging Industry?

European governments are incorporating strict policies, including bans on single-use plastics and initiatives promoting a circular economy, which are major drivers for developing fiber-based and recyclable alternatives. This is driven primarily by stringent environmental regulations, high consumer demand for sustainability, and technological innovations in eco-friendly materials. The boom in e-commerce requires durable yet lightweight and sustainable packaging. Barrier-coated paper solutions are being incorporated into mailers and a few shipping materials to protect products, thus meeting sustainability goals.

U.K. Barrier Coatings for Packaging Market Trends

The U.K. market for barrier coatings for packaging is undergoing steady growth, driven by a strong shift towards sustainable and even recyclable solutions due to government regulations such as the Plastic Packaging Tax and an increase in consumer awareness. There is an increasing partnership between coating providers, paper mills, and packaging converters to advance high-barrier, recyclable, mono-material solutions.

Italy Market Trends

Key trends in the Italian market include a strong shift towards sustainable along recyclable materials, driven by increased user awareness and regulatory compliance, especially for the growing food and beverage sector. Producers are increasingly seeking coatings which can effectively protect against oil, grease, moisture, and vapor to extend shelf life and manage product quality.

More Insights of Towards Packaging:

- Nanocrystal Packaging Coating Market Sees Surge in F&B and Electronics Sectors: Asia Pacific to Boom Next

- Can Coatings Market Trends, Growth, and Market Size Analysis 2034

- Packaging Inks and Coatings Market Growth with Logistics & Distribution Solutions

- Eco-Friendly Barrier Coatings Market Strategic Growth, Innovation and Investment Trends

- Barrier Coatings For Plastic Packaging Market Research, Consumer Behavior, Demand and Forecast

- Packaging Coatings Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- PTFE Tapes and Films Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Rice Paper Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Sauces, Dressings and Condiments Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Release Liners Market Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- High-Barrier Materials for Pharmaceutical Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers

- Mono-oriented Polypropylene (MOPP) Films Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Plastic Dielectric Films Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Monodose Packaging For Probiotic and Nutraceutical Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA)

- Packaging Nets Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Cell Therapy Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

Segment Outlook

Coating Type Insights

Why did the PE Coating Segment Dominate the Barrier Coatings for Packaging Market in 2024?

This is due to their excellent moisture resistance, low expense, and versatility for usage on both paper and plastic substrates. While conventional PE provides great performance, the market is increasingly seeing a shift towards water-driven and bio-based PE coatings as sustainability becomes a bigger driver; meanwhile, PE's foundational benefits continue to fuel its market position.

End Use Industry Insights

Why did the Food Segment Dominate the Barrier Coatings for Packaging Market in 2024?

This is due to its demand to protect a broad variety of products, improve shelf life, and maintain quality. Key factors include the growth of processed and even convenient foods, changing consumer lifestyles, and the expansion of the food service industry, all of which depend on barrier coatings to prevent spoilage from moisture, oxygen, and UV rays. Barrier coatings are used for a vast range of food items, including fresh produce, dairy, bakery items, meats, and confectionery, which has led to the food segment's large market share.

Distribution Channel Insights

Why did the Manufacturers Segment Dominate the Barrier Coatings for Packaging Market in 2024?

This is due to the constant need from the food, beverage, and even pharmaceutical industries, which depend on barrier coatings to prevent spoilage and even maintain product integrity. There is a significant market shift towards sustainable, along with eco-friendly alternatives, like water-based barrier coatings.

These coatings have lower hazardous chemical emissions as well as help producers comply with strict environmental regulations in regions such as Europe and North America. Furthermore, advancements in high-performance coatings for flexible formats, like pouches and films, cater to the growing need for lightweight, cost-efficient, and also convenient packaging solutions.

Recent Breakthroughs in the Global Barrier Coatings for Packaging Industry

- In June 2024, Arcos Dorados Holdings, the largest independent McDonald's franchise in Argentina, collaborated with J&J Green Paper to incorporate sustainable packaging technology, JANUS, which is an all-natural, 100% biodegradable coating that offers a barrier against water, grease, and oxygen when applied to paper-driven food packaging, providing a sustainable option to the current petroleum-derived polyethylene coating.

- In March 2024, Berry Global and Mitsubishi Gas Chemical Company partnered to introduce a recyclable, EVOH-free barrier coating programmed for food packaging applications, mainly targeting thermoformed tubes, jars, and even bottles. This innovative solution utilizes Mitsubishi's MXD6 barrier resin, which aims to improve the recyclability of food packaging while managing product freshness and safety.

Top Companies in the Barrier Coatings for Packaging Market & Their Offerings:

- Sierra Coating Technologies: Offers water-based and eco-friendly barrier coatings for paper and paperboard, including options for high-barrier food-grade packaging that control moisture and oxygen transmission.

- Cork Industries: Specializes in FDA-approved, water-based "poly replacement" barrier coatings that provide oil, grease, and water resistance for various food service packaging applications, such as cups, plates, and folding cartons.

- Sonoco Products: A global provider of consumer and industrial packaging, Sonoco offers its proprietary SonoCoat barrier coatings and has made significant investments in technologies for laminating and coating paper and paperboard products.

- Stora Enso: Provides a wide selection of barrier-coated paperboard materials, including fully renewable and recyclable options with plant-based coatings (Green PE), to replace fossil-based materials in various food and liquid packaging.

- Huhtamaki: A global packaging solutions provider that uses ultra-thin and water-based barrier coatings to create high-barrier, mono-material, and fiber-based packaging solutions that are designed for recyclability or compostability.

- Stahl Holdings: Offers the Barriertec water-based coating solution, which enables fiber-based food packaging (like coffee cups and sandwich wrappers) to become fully recyclable and repulpable by providing effective barriers against water, oil, and oxygen.

- Mica Corporation: Develops water-based oxygen barrier coatings and adhesion promoters for both paper and plastic substrates, offering an environmentally responsible alternative to using multiple material layers in packaging.

- Solenis: Provides the TopScreen portfolio of water-based barrier coatings and biowax formulations that resist water, oil, grease, and oxygen, allowing for recyclable, repulpable, and compostable paper-based packaging solutions.

- H.B. Fuller: Manufactures water-based barrier coatings and complementary adhesives for paper-based food packaging that provide grease and moisture resistance, helping the industry move away from plastic toward more recyclable solutions.

- Dow Chemical: Offers the RHOBARR line of barrier coatings that provide resistance against oil, grease, and hot liquids for foodservice and consumer product packaging, with options for food contact compliance and heat sealability.

- Chemline Global: Provides AQUACOAT water-based barrier coatings as a replacement for plastic extrusion coatings, giving paper and paperboard oil, grease, water, and oxygen barrier properties while remaining eco-friendly and repulpable.

- Avery Dennison: Focuses on labeling and packaging materials, offering adhesive and coating technologies that facilitate the recyclability of plastic packaging and enhance the performance of labels used on various substrates.

Segments Covered in the Report

By Coating Type

- PE Coatings

- PP Coatings

- PET Coatings

- Metallized Coating

- Paper Coatings

- Other Coatings

By End Use Industry

- Food

- Beverage

- Pharmaceutical

- Chemical

- Personal Care & Cosmetics

- Electronics

- Others

By Distribution Channel

- Manufacturers

- Distributors

- Retailers

- E-Retail

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5545

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Halal Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Augmented Reality in Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Cement Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Gusseted Pouches Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Aseptic Bag-in-Box Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2034

- Aluminum Oxide Coated Film Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Hard Coat Film Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Flexitank Market Size, Trends, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Packaging Waste Recycling Market Size, Trends, and Regional Insights (2025-2035)

- Packaging Waste Management Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2035

- Foam Protective Packaging Market Size, Share, Trends, and Forecast Analysis (2025-2035)

- Solid Bleached Sulfate (SBS) Board Market Size, Share, Trends, Segments, Regional Outlook, and Competitive Landscape 2025-2035

- PP Deli Food Container Market Size, Share, Trends, and Forecast Report 2025-2035

- Plastic Tubes Market Size, Trends, Segmentation, Regional Insights, and Competitive Landscape

- Cork Packaging Market Size, Share, Trends, Regional Insights, Segments, and Competitive Landscape

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.