Cut Flower Packaging Market Growth, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

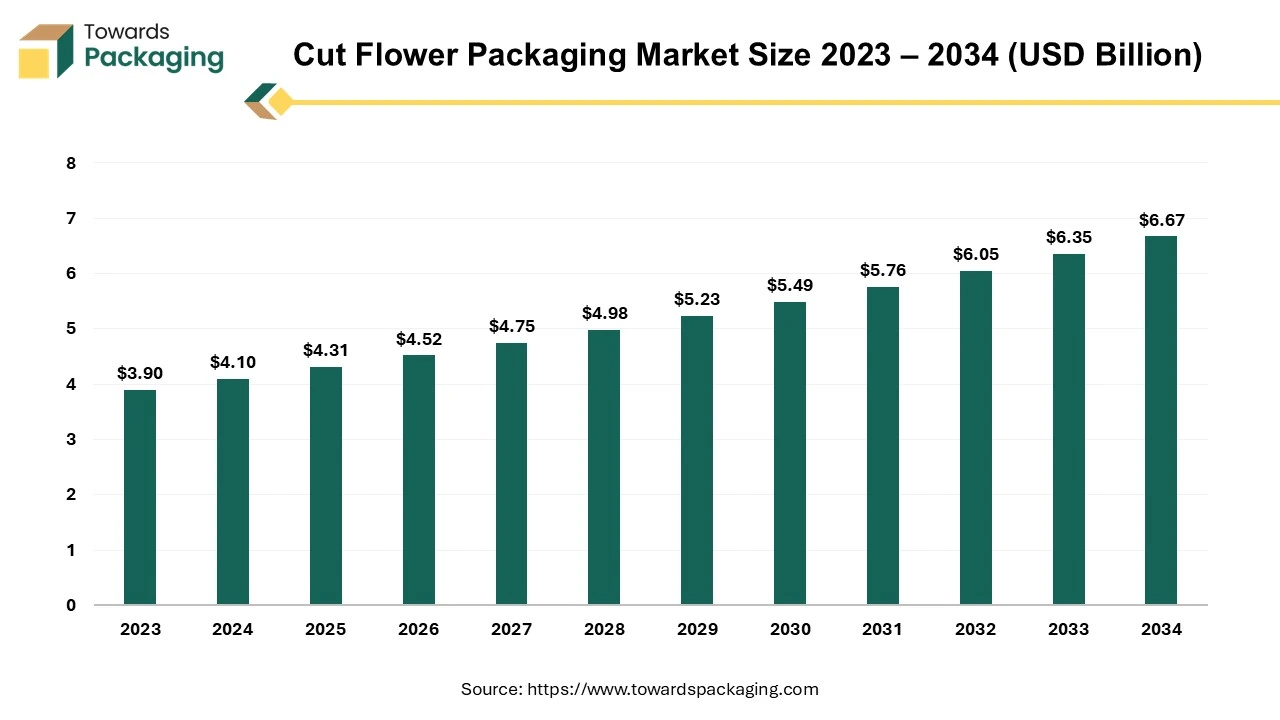

As detailed in the latest report by Towards Packaging, the global cut flower packaging market is forecast to grow from USD 4.52 billion in 2026 to about USD 6.67 billion by 2034, at a CAGR of 5% between 2025 and 2034.

Ottawa, Nov. 12, 2025 (GLOBE NEWSWIRE) -- The global cut flower packaging market which stood at USD 4.31 billion in 2025, is projected to grow further to USD 6.67 billion by 2034, according to data published by Towards Packaging, a sister firm of Precedence Research. The growing demand for fresh cut flowers and the expansion of online flower sales drive the market growth.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Market Overview

The cut flower packaging market growth is driven by the increasing use of fresh cut flowers, the rise in flower home delivery, the strong focus on sustainable packaging, the expansion of aromatherapy, and the growing use of flowers in wellness.

Cut flower packaging is the packaging of cut flowers in boxes, bags, sleeves, & wrapping sheets to prevent damage & maintain hydration. The packaging offers freshness, sustainability, protection, and aesthetic appeal.

Key Private Industry Investments in the Cut Flower Packaging Industry

- Acquisition of Pagter Innovations: Pagter Innovations, a company specializing in reusable transport containers (Procona) designed to keep cut flowers in water, was acquired by a private investor, emphasizing interest in sustainable and efficient logistics solutions.

- Uflex's Investment in Patented Freshness Technology: Uflex heavily invested in the research and development of its patented Flexfresh Modified Atmospheric Packaging (AMAP) film, which allows flowers to be transported via cost-effective sea freight while significantly extending their shelf life.

- Smurfit Kappa's E-commerce Expansion: Smurfit Kappa has made substantial investments in developing a wide range of e-commerce specific, 100% paper-based packaging solutions, including letterbox options, to cater to the growing direct-to-consumer market.

- A-ROO Company's Focus on Earth-Friendly Materials: A-ROO Company has concentrated its investments on developing and promoting "Earth-Friendly Packaging Solutions," including sleeves made from recycled materials, to align with the increasing consumer demand for sustainable options.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5469

Cut Flower Packaging Market Key Trends

- Sustainability: Growing environmental concerns and consumer preference for eco-friendly products are driving the adoption of recyclable, biodegradable, and compostable packaging materials.

- Increased e-commerce demand: The shift toward online flower purchases has created a need for packaging that provides superior product protection during shipping and enhances the unboxing experience for customers.

-

Technological innovation to extend freshness: Advanced packaging technologies, such as Modified Atmosphere Packaging (MAP), are being used to regulate gas and moisture levels inside the package to significantly prolong the flowers' shelf life.

Market Opportunity

Growing Cut Flower Gifting Culture Unlocks Market Opportunity

The increasing gifting of cut flowers on birthdays, weddings, anniversaries, and corporate events increases demand for packaging. The strong focus on enhancing the aesthetic appeal of flowers and increasing the use of flowers to express emotions like sympathy, joy, love, & gratitude requires cut flower packaging.

The rise in the customization of flowers for various occasions and the rise in online flower delivery platforms increase demand for packaging. The growing culture of personalised gifts and the increasing demand for cut flowers for occasions like Mother’s Day and Valentine’s Day requires packaging. The growing cut flower gifting culture creates an opportunity for the market.

Limitations and Challenges

High Capital Investment Limits Market Expansion

With several benefits of cut flowers across various occasions, the high capital investment restricts the market growth. Factors like the need for specialized infrastructure, advanced materials, specialized machinery, and automated packing lines are responsible for high capital investment.

The need for cold storage facilities at airports, farms, & pack-houses, and the need for specialized machinery for processes like wrapping, labeling, sorting, and boxing, increases the cost. The specialized materials like bio-based polymers, moisture-regulating foils, and specialized barrier films require a high cost. The need for skilled labor and high-quality planting materials increases the cost. The high capital investment hampers the growth of the market.

More Insights of Towards Packaging:

- Corrugated Open-head Drums Market Size, Trends, Share, Trends, Segments

- Eco-Friendly Barrier Coatings Market Size, Trends, Key Segments, and Regional Dynamic

- Aseptic Flex Bag Market Size, Trends, Segments, Companies, Competitive Analysis

- 3D-Printed Stickers & Labels Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA)

- BioProcess Container (BPC) Market Size, Trends, Segments, Companies, Competitive Analysis

- Airless Pumps Market Size, Trends, Key Segments, and Regional Dynamics

- Box and Carton Overwrap Films Market Size, Trends, Key Segments, and Regional Dynamics

- Bagging Machines Market Size, Trends, Share, Trends, Segments, and Regional Insights

- Fertilizer Bag Market Size, Trends, Segments, Regional Insights, and Competitive Landscape

- Aseptic Processing and Packaging Market Size, Share, Trends, and Forecast Analysis

- Retail Press Dispenser Pump Market Size, Share, Trends, Growth Forecast (2025-2035)

- Daily Chemical Product Stand Up Pouches Market Size, Share, Trends, and Forecast Analysis

- Compostable Shrink Wrap Market Size, Share, Trends, Segments, Regional Outlook

- Beverage Closures Market Size, Share, Trends, Segments, and Regional Outlook to 2035

-

Pillow Shape Aseptic Packaging Material Market Size, Share, Trends and Segment

Regional Insights

Why Europe Dominates the Cut Flower Packaging Market?

Europe dominated the market in 2024. The presence of sophisticated greenhouse systems and a strong cultural affinity for flowers increases demand for cut flower packaging. The high consumption of cut flowers and the growing cultural importance of flowers on occasions like anniversaries, Christmas, birthdays, and easter requires cut flower packaging. The strong focus on sustainable packaging and the presence of Royal Flora Holland in the Netherlands drive the overall growth of the market.

Netherlands Cut Flower Packaging Market Trends

The Netherlands dominates the European Market due to its well-established position as the leading hub for flower production, trading, and export across the continent. The country's world-renowned flower auction system in Aalsmeer facilitates large-scale trade, driving continuous demand for efficient, durable, and attractive packaging materials. Its advanced logistics and cold chain infrastructure ensure that flowers maintain freshness during transport, increasing the reliance on high-performance packaging solutions such as moisture-resistant films and temperature-controlled boxes.

How Asia Pacific is Experiencing the Fastest Growth in the Cut Flower Packaging Industry?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing demand for flowers across various events, ceremonies, and festivals increases demand for cut flower packaging. The strong focus on urban beautification and increasing spending on flowers for personal use in India & China helps market growth. The rise in online sales and high demand for eco-friendly packaging increases demand for cut flower packaging. The major export of cut flowers and the rise in adoption of healthy lifestyles support the overall market growth.

China Cut Flower Packaging Market Trends

China dominates the Asia Pacific Market due to its vast flower cultivation base and expanding floral export industry. The country's strong manufacturing capabilities enable large-scale production of affordable and diverse packaging materials such as plastic sleeves, paper wraps, and boxes. Rapid urbanization and rising disposable incomes have boosted domestic flower consumption, further driving demand for high-quality and visually appealing packaging.

Market Segmentation

Product Type Insights

Why the Sleeves Segment Dominates the Cut Flower Packaging Market?

The sleeves segment dominated the market in 2024. The high-volume distribution of flowers and focus on providing a good level of protection for flowers increase demand for sleeves. The strong focus on aesthetic appeal and the rise in e-commerce require sleeves. The cost-effectiveness, ease of handling, and convenience of sleeves are driving the overall market growth.

The wrapping sheets segment is the fastest-growing in the market during the forecast period. The growing need for recyclable materials and increasing environmentally conscious consumers requires wrapping sheets. The strong focus on creating a personalised & premium unboxing experience and expansion of online flower sales requires wrapping sheets. The growing demand for physical protection against tangling & damage increases the adoption of wrapping sheets, supporting the overall market growth.

Material Type Insights

How did Plastic Segment Hold the Largest Share in the Cut Flower Packaging Market?

The plastic segment held the largest revenue share in the market in 2024. The growing need for superior protection and focus on preserving the freshness of flowers requires plastics. The availability of plastic in various forms, like protective films and wraps, helps the market growth. The growing large-scale export packaging and initial retail packaging require plastics, driving the overall market growth.

The jute segment is experiencing the fastest growth in the market during the forecast period. The strong focus on biodegradable packaging and premium aesthetic appeal increases the adoption of jute. The increasing awareness about environmental issues and restrictions on single-use plastic bags requires jute. The cost-effectiveness and high durability support the overall market growth.

Sales Channel Insights

Why the Florists Segment is Dominating the Cut Flower Packaging Market?

The florists segment dominated the market in 2024. The growing demand for customized packaging and the focus on direct customer interactions require florists. The florist's expertise in floral arrangement and the growing demand for special occasions like weddings, Valentine’s Day, and Mother’s Day drive the overall market growth.

The online sales segment is the fastest-growing in the market during the forecast period. The growing use of flowers for personal wellness and home décor increases the buying online. The tradition of gifting flowers and online subscription services for fresh flowers helps market growth. The growing online presence of traditional brick-and-mortar florists and a strong focus on home delivery support the overall market growth.

Flower Type Insights

Which Flower Type Held the Largest Share in the Cut Flower Packaging Market?

The bouquet segment held the largest revenue share in the market in 2024. The growing gifting of flowers across occasions like holidays, birthdays, and anniversaries increases demand for bouquet. The presence of decorative elements like wrapping paper and ribbons helps market growth. The variety of flowers in bouquets and the increasing need in the commercial sector drive the overall market growth.

The single cut segment is experiencing the fastest growth in the market during the forecast period. The growing expansion of online flower sales and the trend of unique gifting options increase demand for single cut. The increasing awareness about sustainability concerns and the rise in the number of flower shops require a single cut. The rapid growth in the gifting culture and innovations in packaging technology support the overall growth of the market.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the Cut Flower Packaging Market & Their Offerings

Tier 1:

- DS Smith: DS Smith provides sustainable, fiber-based corrugated cardboard boxes and e-commerce solutions for cut flowers, focusing on product protection, moisture retention, and recyclability.

- Smurfit Kappa Group: The company offers a diverse portfolio of 100% paper-based e-commerce and export packaging solutions, including telescopic packs and letterbox options, designed for maximum product protection and a positive unboxing experience.

- Uflex: Uflex's primary offering is a patented active modified atmospheric packaging (AMAP) film called Flexfresh, which extends the shelf life of flowers by maintaining freshness for up to 7-14 days without water, allowing for more economical sea freight transport.

- Clondalkin Group: Clondalkin Group (now Clondalkin Flexible Packaging) provides various flexible packaging solutions, including protective sleeves and wraps, which focus on preserving freshness and enhancing the aesthetic appeal of flowers during transport and retail.

- Atlas Packaging: Atlas Packaging manufactures corrugated cardboard packaging solutions, such as boxes and sleeves, for the flower industry, which are designed for durability and protection during transit.

- Sirane Limited: Sirane offers specialized packaging solutions for fresh produce, including breathable films and bags that help extend the shelf life of cut flowers during storage and transportation.

- Mos Packaging Printing Factory: This company provides various packaging formats for cut flowers, including wrap sheets, sleeves, and boxes/cartons, combining functional protection with aesthetic finishes.

- A-ROO Company: A-ROO specializes in a broad range of flower packaging products such as sleeves, sheets, and pot covers, with a current focus on providing "Earth-Friendly Packaging Solutions".

-

Koen Pack: Koen Pack offers an extensive array of flower and plant packaging supplies, including gift bags, sleeves, wraps, and decorative items, serving florists and retailers globally.

Tier 2:

- Smurfit Kappa Group (Duplicate)

- FloPak

- Robert Mann Packaging

- Pacombi Group

- Hawaii Box & Packaging

- Packaging Industries Ltd

- Dilpack Kenya

Recent Developments

- In August 2025, Seaman Paper launched tissue paper leased, the SatinWrap Floral product line for cut flowers. It is specifically designed for floral packaging distributors and florists. The product line has 14 premium in-stock colors and is designed to meet the demands of every celebration & season.

- In October 2024, Bercomex launched a new Rosematic bunch-binding station. The station produces less waste and higher-quality rose flowers. The station preserves the quality of bouquets and consists of AI-supported vision technology.

- In June 2023, Decowraps launched sustainable packaging film, EvolveFlex, for floral packaging. It is made up of 90% PCR and offers a diverse range of transparency & thickness options. It is available in CPP & HDPE versions and used in the packaging of potted plants & cut flowers.

Segments Covered in the Report

By Product Type

- Sleeves

- Wrapping Sheets

- Boxes & Carton

- Poles

- Bags

- Metal Stands

By Material Type

- Paper & Paperboard

- Plastic

- Metal

- Jute

- Others

By Sales Channel

- Florists

- Supermarkets & Retail Stores

- Online Sales

By Flower Type

- Single Cut

- Bunch/ Bouquet

By Region:

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5469

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Canned Glass Packaging Market Size, Share, Trends, and Forecast 2025-2035

- Alcoholic Beverage Glass Packaging Market Size, Trends, Regional Insights

- Rigid Chilled Food Packaging Market Size, Share, and Forecast Analysis (2025-2035)

- Plastic Turnover Box Market Size, Trends, Competitive Landscape, Global Industry Analysis

- Duplex Paper for FMCG Market Size, Growth Trends, Segmentation, Regional Insights

- Dairy Aseptic Packaging Material Market Size, Trends, Segmentation

- Beer Glass Packaging Market Size, Share, Trends, and Forecast 2025-2035

- Recyclable Shrink Film Market Size, Trends, and Competitive Landscape

- Plastic Tray and Container Market Size, Trends, Segmentation

- Compostable Tray Market Size, Share, Trends, Segments, and Regional Insights

- Single-use Pouches Market Size, Share, Trends, Segmentation, and Regional Outlook

- Stretch Hooder Packaging Film Market Size, Trends, Segmentation, Regional Insights

- PTP Aluminum Foil for Pharmaceutical Package Market Size, Trends, Regional Outlook

- Pharmaceutical Cold Chain Logistics Packaging Market Size, Trends, Segments

-

Pallet Tanks Market Size, Share, Trends, and Segment Analysis by Type, Application, and Region

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.